Bidenomics: U.S. Economy Added Fewer Jobs Than Expected In January

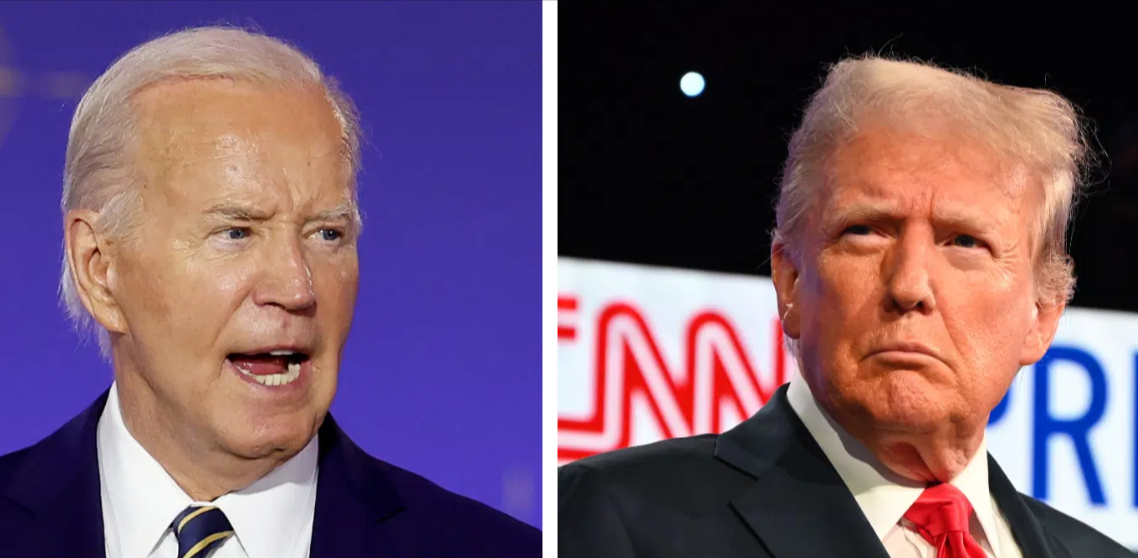

The lingering effects of the Biden administration surfaced once again in January.

The U.S. job market saw less growth than expected during the month, as the Federal Reserve remained cautious, awaiting further labor market and inflation data before making decisions on interest rates, according to a report from Fox Business.

Despite this, the unemployment rate stood at 4 percent, which was lower than economists had predicted.

“The number of jobs added in the prior two months were both revised, with job creation in November revised up by 49,000 from a gain of 212,000 to 261,000, while December was revised up by 51,000 from a gain of 256,000 to 307,000. Taken together, 100,000 more jobs were created in those two months than previously reported,” the report stated.

Government data revealed that the private sector was projected to add 141,000 jobs but fell short, adding only 111,000.

On a positive note, wages experienced a half-percent increase from the previous month and a 4.1 percent rise compared to the same period last year. Additionally, the manufacturing sector added 3,000 jobs, a significant improvement from the anticipated loss of 2,000 jobs.

The retail industry saw an increase of 34,300 jobs in January, with general merchandise retailers adding 31,200 positions and furniture retailers contributing 5,300 jobs.

Conversely, electronics and appliance retailers faced a decline, shedding 7,000 jobs.

“Social assistance added 22,300 jobs, led by individual and family services (+20,100) with gains also occurring in community food and housing, emergency and other relief services (+4,400). The sector grew by an average of 20,000 jobs a month last year,” the report noted.

“The mining, quarrying and oil and gas extraction industry lost 7,700 jobs in January, with losses concentrated in mining support activities. The sector experienced little net change in 2024,” it continued.

Workforce participation remained steady at 62.6% following adjustments for population controls by the Bureau of Labor Statistics (BLS).

At the latest Federal Reserve meeting, officials opted not to reduce interest rates for the fourth consecutive quarter.

Federal Reserve Chairman Jerome Powell stated that a “wide set of indicators suggest that conditions in the labor market are broadly in balance,” emphasizing that while inflation remains elevated, the labor market is not a primary contributor to these pressures.

“A lower-than-expected January payrolls number was more than offset by upward revisions to November and December’s totals and a downtick in the unemployment rate,” said Ellen Zentner, chief economic strategist at Morgan Stanley Wealth Management. “Those who’d hoped for a soft report that would nudge the Fed back into rate-cutting mode didn’t get it.”

“In general, labor demand last year was softer than originally reported but that trend temporarily reversed in November and December. An unemployment rate at 4% is considered very low, giving the Fed reason to keep the fed funds unchanged in the near term,” stated LPL Financial chief economist Jeffrey Roach, who described the report as a “Goldilocks report — not too hot and not too cold.”

Looking ahead, more jobs are expected to emerge.

In December, former President Trump announced a significant $100 billion investment in the U.S. by SoftBank.

Speaking from Mar-a-Lago, the 47th president was joined by SoftBank Group CEO Masayoshi Son as they unveiled SoftBank’s plan to invest $100 billion in the United States over the next four years.

Masayoshi Son expressed his growing confidence in the U.S. economy, stating that his “confidence level” had “tremendously increased with [Trump’s] victory.” He further added, “Because of that – I am committing $100 billion and 100,000 jobs into the United States. This is double of last time… because President Trump is a double-down president.”

Trump hailed the investment as proof of “monumental confidence in America’s future.” In a lighthearted exchange, he encouraged Son to consider a $200 billion investment. Son laughed and said he would try.

Trump also commended Son, calling him “one of the most accomplished business leaders of our time,” as reported by Reuters.