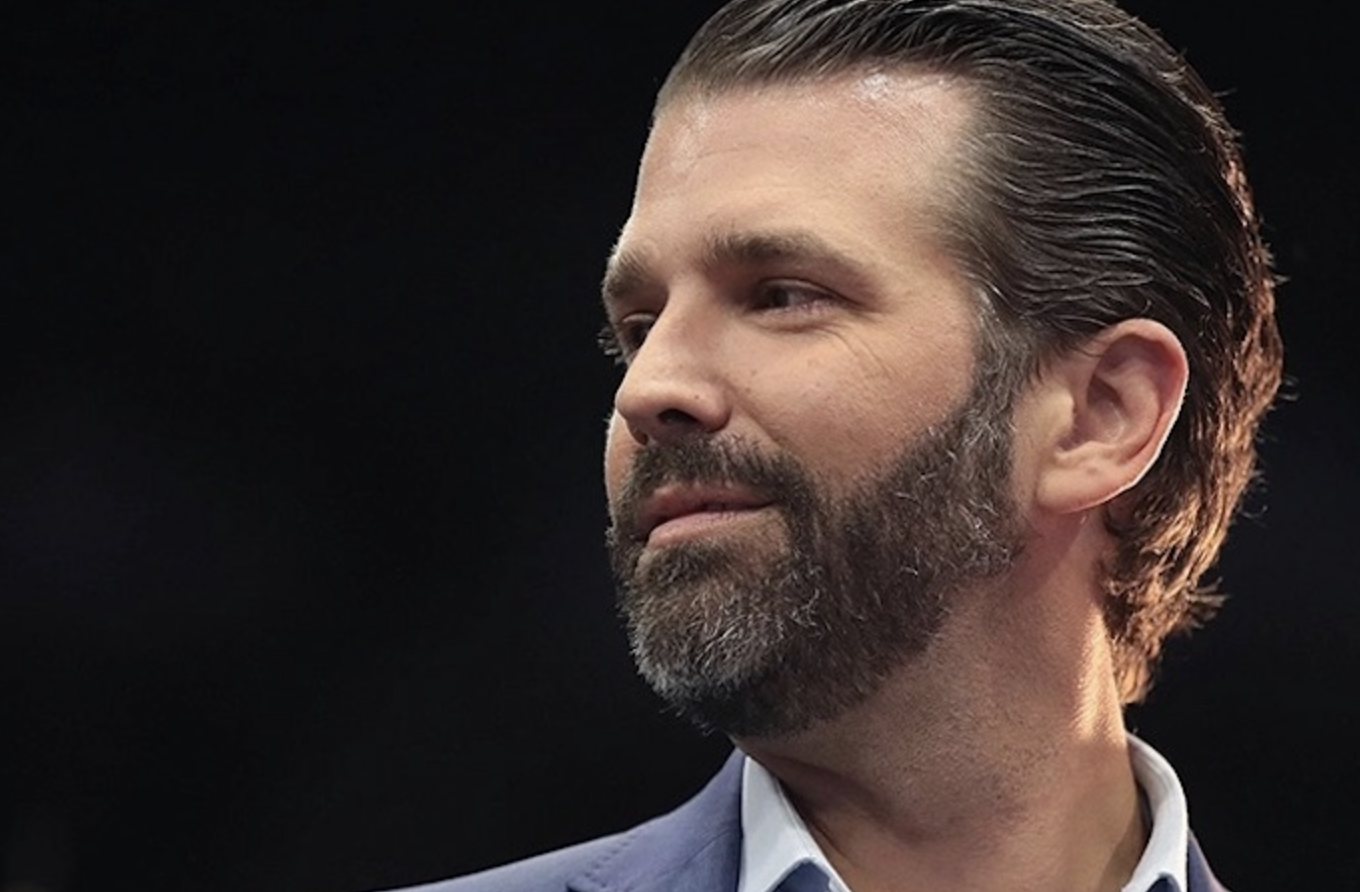

Don Jr. Sends Shockwaves With Announcement About His New Role

Donald Trump Jr. is making waves with his announcement of a new role at 1789 Capital, an “anti-woke” venture capital firm that focuses on right-leaning businesses. The firm, whose flagship investment is Tucker Carlson’s media project, is adding Trump Jr. as a partner.

According to the New York Times, Trump Jr. informed a group of donors on Sunday that he would take on this new position at the MAGA-aligned investment firm instead of joining his father’s administration. As a prominent figure in his father’s presidential campaign, Trump Jr. served as a vocal advocate and advisor. He was also instrumental in pushing for Vice President-elect JD Vance to join the ticket and has been involved in evaluating candidates for the new administration, prioritizing their loyalty to Donald Trump Sr.

1789 Capital derives its name from the year the Bill of Rights was adopted and promotes what it calls "entrepreneurship, innovation, and growth" (EIG). The firm takes a clear stance against environmental, social, and governance (ESG) investing, which co-founder Omeed Malik has referred to as a “cult.” Malik explained the firm's mission is to provide funding to startups that align with principles like “deglobalization,” echoing themes of Trump’s populist agenda.

Malik, a former managing director at Bank of America, revealed that his political shift came during the pandemic. Once describing himself as a “run-of-the-mill corporate Democrat,” he said skepticism of public health measures pushed him further to the right. On The Adam Carolla Show, he remarked, “Rage Against the Machine requiring a vaccine passport to go to their show: this is an upside-down world that we live in.”

Malik co-founded 1789 Capital with Rebekah Mercer, the hedge fund heiress who is also an investor in The Daily Caller. Earlier this year, both served as co-chairs for a Trump campaign fundraising dinner that reportedly brought in over $50 million.

The firm made its first major investment last year, providing $15 million in seed funding for Tucker Carlson’s new media venture after his exit from Fox News. It has also invested in Firehawk, a startup developing 3D-printed rocket fuel for missiles.

Trump Jr.’s entry into the investment world aligns him with other family members involved in finance. Jared Kushner, his brother-in-law, leads the private equity firm Affinity Partners. While 1789 Capital’s initial funding of $150 million is modest compared to Kushner’s ventures, the firm’s ambitions will rely on Trump Jr.’s ability to navigate and secure deals in this politically charged space.