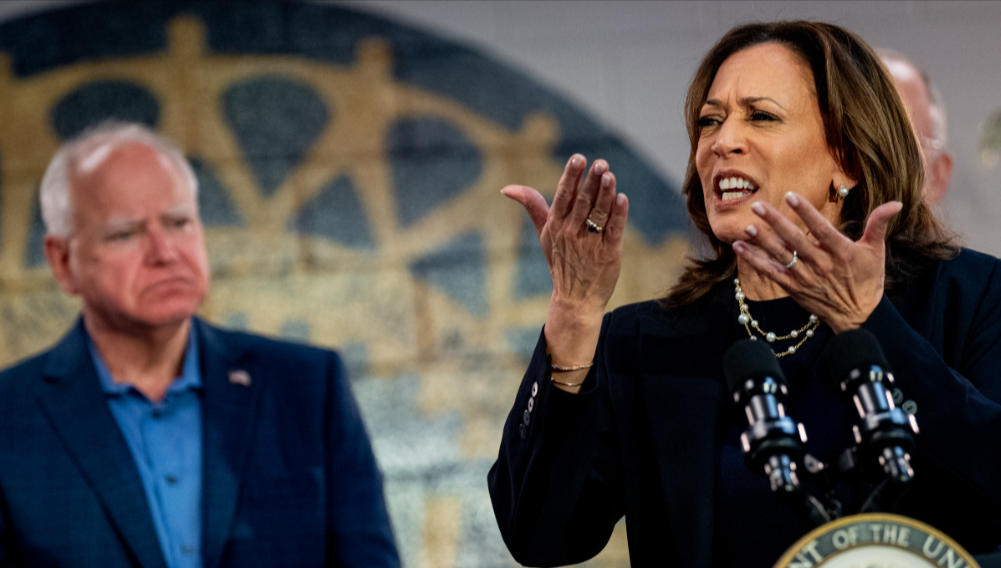

Ouch! House Dem Shreds Harris-Walz Economic Policies

A prominent House Democrat and surrogate for Vice President Kamala Harris, Rep. Ro Khanna, has voiced criticism of her economic and tax proposals, arguing that they could be detrimental to the country.

During an appearance on CNBC’s Squawk Box, Khanna discussed Harris’s plan to tax unrealized capital gains, which has sparked significant skepticism from hosts Joe Kernen, Andrew Ross Sorkin, and Rebecca Quick. The proposal aims to impose a 25% minimum tax on unrealized capital gains for individuals with a net worth exceeding $100 million. This policy would require Americans to pay taxes on the increased value of assets, such as stocks and bonds, even if those assets haven’t been sold.

Unrealized gains, often referred to as "on paper" gains, reflect the increase in value of an asset that has been purchased but not yet sold. The gain or loss becomes "realized" only when the asset is sold, according to Bankrate. Critics have noted that if an asset’s value drops the following year, taxes would have already been paid on a higher valuation, leading to potential financial complications.

Khanna, who represents California’s 17th District, including Silicon Valley, expressed reservations about the plan, despite his broader support for the Harris campaign. He argued that the policy could harm entrepreneurs and create an unfavorable environment for startups.

“If you’re an entrepreneur and you build a company that reaches $100 or $200 million in value on paper, taxing that could force them to sell. In many cases, this would mean selling to private equity firms. Is that really what you want for the startup ecosystem?” Khanna questioned.

Host Joe Kernen added to the conversation, arguing that wealthy figures like Jeff Bezos would not be as affected by the policy. “They’re targeting these very specific groups—it feels like demagoguery,” Kernen said.

Khanna proposed an alternative approach, suggesting that individuals be taxed on loans taken against appreciated assets, noting that this is a common strategy used by wealthy families to avoid taxes on unrealized gains.

“I understand the intention behind Harris’s plan,” Khanna said. “But this isn’t the right way to achieve it. And with 90 to 95% of startup investments failing, this could discourage future investments in innovation.”

Meanwhile, economic worries are growing for everyday Americans. A new survey shows nearly 40% of people are concerned about being able to pay their bills on time, a figure higher than during the 2008-09 Great Recession.

According to a CNN poll, 39% of Americans now fear they may struggle to meet their financial obligations, a 33% increase since inflation spiked under the Biden-Harris administration. This percentage surpasses the 37% recorded during the 2008 financial crisis when unemployment neared 10%, CNN reported.

Despite a slight easing of inflation in recent months, the cost of essential goods such as food, gas, housing, and utilities remains elevated. CNN reported that “consumers are still trying to catch up to the price spikes of the last few years.”

The Daily Signal, citing the same survey, elaborated further:

"Catching up" may be an understatement. Since 2021, the gap between nominal wages and inflation-adjusted earnings is more than 20%. While workers may appear to be earning more on paper, inflation has effectively caused them to lose thousands of dollars in real income.

If official inflation figures don’t reflect the full reality—as some analysts suggest—based on rising costs in housing, restaurants, and groceries, workers could be losing even more than reported.

To put this in perspective, official inflation since COVID-19 has been recorded at 21%, yet fast-food prices, often used as a proxy for true inflation, have risen more than twice as much. Additionally, housing costs have doubled since the pandemic, with home prices and mortgage rates both climbing sharply.

If these real-world indicators are closer to the true inflation rate, workers could be losing thousands of dollars each month.