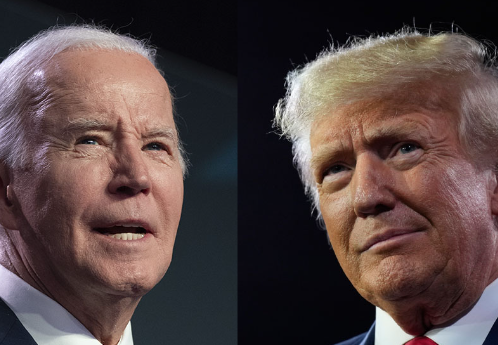

Supreme Court Development Could Rock 2024 Election

The Supreme Court has become a significant challenge for President Joe Biden, consistently issuing rulings that go against his policy objectives. It appears that the Court is poised to hinder the president’s efforts to move the nation further left on the political spectrum.

For example, the potential abandonment of Biden’s proposals to impose taxes on high-income individuals may arise following the Supreme Court’s recent ruling, which found Biden’s student loan forgiveness plan of over $430 billion to be unconstitutional.

One significant case that could impact President Biden is Moore v. United States. The court is scheduled to deliberate on numerous cases during the upcoming autumn term, including matters such as the right to bear arms, federal agency jurisdiction, and the potential trademark ability of the phrase “Trump too small.”

The focus of discussion revolves around President Biden’s repeated support for a wealth tax and its feasibility.

According to SCOTUS Blog, the central inquiry in this issue relates to the authorization granted by the 16th Amendment to Congress, specifically “Whether the 16th Amendment authorizes Congress to tax unrealized sums without apportionment among the states.” The 16th Amendment gave Congress the legal authority to impose an income tax, marking a significant milestone in the nation’s history.

During the State of the Union speech earlier this year, President Biden expressed his backing for a proposal regarding a billionaire minimum tax. “Reward work, not just wealth. Pass my proposal for a billionaire minimum tax. Because no billionaire should pay a lower tax rate than a school teacher or a firefighter.”

According to The Washington Examiner, “Biden later proposed a 25% annual tax on all gains to wealth in excess of $100 million in a given year, including unrealized capital gains which aren’t currently taxable. The White House says that the tax would only apply to the top 0.01% of the highest earners. While the proposal faces long odds with a Republican-controlled House of Representatives, it could be nixed permanently if the high court rules such a tax is unconstitutional.”

“The specifics of the Moore case don’t involve huge amounts of money, but center around the same issues of taxation and the definition of the word ‘income,’” the Examiner continued. “Charles and Kathleen Moore, a Washington state-based couple, made a nearly $40,000 investment into an Indian company in 2005 and never received any money or other payments from the company even though it made a profit every year.”

Numerous entities have submitted amicus briefs in the legal matter, including the libertarian CATO Institute, which argued that President Biden’s action would be deemed unconstitutional in accordance with constitutional principles.

According to the brief filed by the group in March, “Since the ratification of the Sixteenth Amendment, this Court has consistently interpreted ‘income’ as referring to amounts that the taxpayer realizes in a particular accounting period. Therefore, this Court has consistently treated contemporaneous realization of income as a constitutional prerequisite to a tax that is not subject to the apportionment requirement set forth in Article I.”

“In holding that the Mandatory Repatriation Tax is constitutional, the Ninth Circuit rejected this well-established principle and contradicted this Court’s precedents. The Ninth Circuit’s approach contorted the definition of ‘income’ beyond recognition,” the brief adds.

The group expressed concern that “If a tax on unrealized investment holdings like the Mandatory Repatriation Tax can be treated as an ‘income’ tax, then anything can be treated as an income tax. And if anything can be treated as an income tax, then the Sixteenth Amendment’s limitation to ‘income’ taxes is meaningless.”

According to an amicus brief submitted this month by the U.S. Chamber of Commerce, “Businesses rely on predictability and certainty in tax laws to plan their affairs.”

The group further emphasized that “If income can be redefined as easily as the Ninth Circuit says, then businesses and their shareholders could be subject to taxes on anything that the government later deems ‘income’—even increases in value that could disappear as valuations or markets fluctuate. Such a realization-free approach risks profound uncertainty in an area of the law that demands certainty.”

In the upcoming fall term, the Court is set to consider several cases that present favorable opportunities to limit the powers of the federal administrative state.

The court has agreed to adjudicate cases challenging the constitutionality of an agency funding scheme exempt from the congressional appropriations process and regular oversight. It will also review federal courts' practice of granting judicial deference to agency interpretations of the laws they enforce.

Additionally, the court will consider a case with the potential to reinstate jury trials in certain civil matters currently adjudicated exclusively by administrative body-employed judges. SEC v. Jarkesy is expected to be a significant case in the forthcoming term due to its potential to restore the entitlement to a jury trial in administrative civil matters.